Suranjana TewariAsia Business Correspondent

Reuters

ReutersIn late September, the Dutch government invoked a Cold War-era emergency law to take control of a Chinese-owned chip company that has operations in the country.

The extraordinary move set off a chain of events that sent shock waves through the global motor industry – already battered by US tariffs and China’s curbs on rare earth exports.

In a statement to the Netherlands parliament, the minister of economic affairs cited “serious governance shortcomings and actions within Nexperia” that “posed a threat”.

“This measure is highly exceptional and intended solely to ensure that the continuity of supply and safeguarding of critical technologies for the Dutch and European economy are not put at risk,” the statement said.

Beijing reacted furiously, accusing the Netherlands of political interference.

It imposed export controls and halted deliveries of Nexperia chips from its Chinese facilities to Europe, while the Dutch government froze shipments of key supplies needed to make the chips in China.

The disruption caused to the motor industry highlighted a major weakness in the global supply chain of chips vital to car production and opened yet another front in the rivalry between the US and China.

The Chinese government has now granted exemptions to export controls on the chips for civilian applications but has not clarified what it considers those to be.

But Chinese authorities still want the Dutch to revoke the takeover of Nexperia.

“China welcomes the EU to continue exerting its influence to urge the Netherlands to correct its erroneous practices as soon as possible,” the commerce ministry said in a statement on Sunday.

Nexperia’s parent company Wingtech Technology did not respond to a BBC request for comment.

Weaponising supply chains

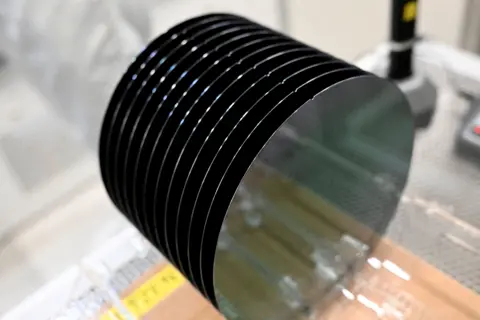

At the centre of the dispute is a critical part of the world’s chip ecosystem.

Nexperia makes so called “legacy” or “building block” semiconductors that are vital for everything from power-steering and airbags to central locking systems. These are not cutting-edge chips, but they are still indispensable.

Some vehicles contain hundreds of them, and Nexperia supplies chips to major carmakers around the world.

Around 70%-80% of its output is sent to China for processing, testing and packaging – a dependence that has left car makers exposed to Beijing’s control over supply chains.

“Car markers blindsided by the Nexperia mess should be hiring new supply chain management executives, as they clearly learned nothing from Covid… and excessive reliance on [Chinese] supply chains,” China watcher Bill Bishop wrote in his Sinocism newsletter.

It underscores China’s ability to choke off global supply chains – just as it did with rare earth exports.

Similar to critical minerals, China can hold the West hostage with control of a company as inconspicuously important as Nexperia, according to Bill Echikson, Senior Fellow for the Tech Policy Program at Center for European Policy Analysis. This is as much about digital sovereignty as it is about semiconductors, he adds.

Beijing faces a dilemma though. It has been pitching itself as a reliable partner in the face of Trump’s tariff chaos, but cutting off supplies of critical products risks undermining that message.

“The narrative was [that, since] Trump came in and caused chaos for everybody, maybe there’s an opportunity for China and the EU to work more closely together,” said Tom Nunlist, Associate Director at Trivium China.

That didn’t go so well, he adds, with the rare earths shortage showing how trapped Europe and other trading partners are between the US and China, and their ability to upend global trade, according to Mr Nunlist.

National security

Along with the takeover, a Dutch court also suspended Nexperia’s former chief executive Zhang Xuezhen – who founded its Chinese owner Wingtech – citing mismanagement.

Wingtech’s shares trade on the Shanghai Stock Exchange and it is partially owned by the Chinese government.

It was placed on an official US watch list in 2024, and the so-called entity list was expanded this September to include any firm that is at least 50% owned by companies already on the list.

According to court papers released by the Dutch authorities last month in relation to the government’s takeover of Nexperia, US authorities had raised concerns about the boss of the chip company before it was taken over.

The documents contained evidence that Dutch authorities had told Nexperia it may be able to secure an exemption from the US list if there was a change in leadership because the “Chinese owner is problematic”.

“It is almost certain that the CEO will have to be replaced to qualify for the exemption from the entity list,” authorities told Nexperia, according to the documents.

Reuters

ReutersThe Hague denies the takeover of Nexperia was a response to pressure from any foreign country but said there was evidence to suggest the company’s chief executive was transferring its production capacity, financial resources and intellectual property to China.

Wingtech did not respond to a request for comment on this.

“I think Nexperia just underlines what is already true, and makes it truer,” said Mr Nunlist from Trivium China.

“Western countries don’t want Chinese investors in these types of strategic manufacturing assets, even legacy chips.”

Car makers on edge

Experts say the incident is an example of the very real impact of undoing business and economic ties between the West and China.

“This is what decoupling actually looks like at the corporate level, and it’s a huge mess,” said Mr Nunlist.

European vehicle industry suppliers have sought clarity on the exemptions that will be applied, and have said it creates extra bureaucracy at an already uncertain time.

Getty Images

Getty ImagesIt is possible to switch suppliers, say experts, as rivals chip makers like Infineon, NXP and Texas make similar chips.

But supply chains are not precisely planned, they evolve organically and these components are often tailor made for autos, Mr Nunlist of Trivium China said.

“Companies can’t move on a dime; there are incentives to keep supply chains in place and it’s extremely complicated and costly to change things.”

Fragile truce

The incident comes as US President Donald Trump and China’s President Xi Jinping agreed to a one-year trade truce – a deal which suspended some export bans and rare earth restrictions.

But the Nexperia dispute suggests that this newly-minted agreement may be a fragile one.

The US is not going to blow up the deal though, according to Mr Nunlist, and Europe doesn’t have much leverage especially in this game of supply chain weaponisation.

“This is really politically tricky for both sides, and for Europe because it doesn’t want this to end with chip capacity leaving Europe,” Mr Nunlist said.

“My understanding is that leaders in Brussels were unaware that the Dutch government was planning to make this move and were unhappy with it.”

China and the EU remain locked in urgent negotiations to lift export controls on both chips and rare earths.

Talks are continuing with China on finding a “lasting, stable, predictable framework that ensure the full restoration of semiconductor flows”, EU trade commissioner Maros Sefcovic said in a post on X over the weekend.

But the episode has exposed vulnerabilities in key supply chains – and ties between China and the Netherlands, and in turn the European Union, are likely to remain under pressure until the discord over Nexperia’s ownership and operations is fully resolved.